Fixed mortgage rates reverse course for the first time this year

A

Freddie Mac sign stands outside the company's headquarters in McLean,

Virginia, U.S., on Tuesday, April 8, 2014. Senator Sherrod Brown, an

Ohio Democrat and a member of the Senate Banking Committee, said a

bipartisan bill to replace Fannie Mae and Freddie Mac is too complicated

and doesn't do enough to address too-big-to-fail concerns or provide

assistance for affordable housing. The panel will consider the measure

on April 29. Photographer: Andrew Harrer/Bloomberg (Andrew

Harrer/Bloomberg News)

Fixed mortgage rates moved lower for first time in 2018.

According

to the latest data released Thursday by Freddie Mac, the 30-year

fixed-rate average slipped to 4.44 percent with an average 0.5 point.

(Points are fees paid to a lender equal to 1 percent of the loan

amount.) It was 4.46 percent a week ago and 4.3 percent a year ago.

The

15-year fixed-rate average fell to 3.9 percent with an average 0.5

point. It was 3.94 percent a week ago and 3.5 percent a year ago. The

five-year adjustable rate average rose to 3.67 percent with an average

0.4 point. It was 3.63 percent a week ago and 3.28 percent a year ago.

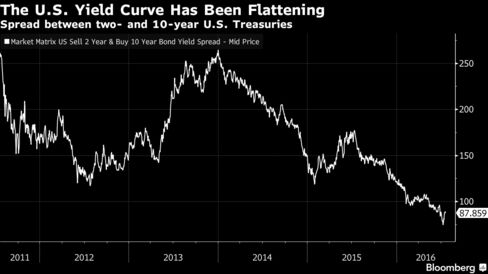

“After

holding steady for much of the week — even through Friday’s

exceptionally strong jobs report — rates fell for the first time this

year after inflation data reported Tuesday were weaker than anticipated,

and news of the firing of Secretary of State Rex Tillerson prompted

some financial market flight to safety,” said Aaron Terrazas, senior

economist at Zillow. “Beyond the continued risk of geopolitical

developments, the Fed is expected to raise short-term interest rates at

next Wednesday’s [Federal Open Market Committee] meeting. The press

conference following the meeting will be Chairman [Jerome] Powell’s

first since taking over in mid-February and markets will study the

FOMC’s quarterly forecasts for signals about the committee’s unspoken

monetary policy leanings.”

Bankrate.com, which puts out a weekly mortgage rate trend index,

found that nearly two-thirds of the experts it surveyed say rates will

remain relatively stable in the coming week. Shashank Shekhar, the chief

executive of Arcus Lending, is one who expects rates to hold steady.

“Rates

went up too quickly at the beginning of the year and are now simply

taking a pause,” Shekhar said. “Mortgage-backed securities, the trading

of which directly influences the rate, seems to be agnostic even to big

personnel changes in the White House and Britain’s action against

Russia. It would take something even more dramatic and unexpected for

the mortgage rates to move by a big margin either way, up or down.”

Meanwhile,

mortgage applications were flat again last week, according to the

latest data from the Mortgage Bankers Association. The market composite

index — a measure of total loan application volume — increased 0.9

percent from a week earlier. The refinance index fell 2 percent, while

the purchase index rose 3 percent.

The refinance share of mortgage activity accounted for 40.1 percent of all applications, its lowest level since September 2008.

“Although

the purchase market continues to be constrained by a lack of supply,

applications for home purchase loans increased 3 percent last week to

the highest level in over a month, as demographic and economic

conditions remain favorable for housing demand,” said Joel Kan, an MBA

economist. “Refinance activity remains weak as rates have increased in

essentially every week of 2018 thus far, reducing the benefit of a

refinance for those borrowers currently in the market.”

Robert Bobby Darvish Platinum Lending Solutions Orange County California