43% of homeowners have delayed home improvements and maintenance due to inflation. Here’s why that’s risky

- Inflationary pressures have caused some homeowners to delay big projects related to home ownership, a new study shows.

- The cost of financing renovations or improvements is also getting more expensive, with interest rates on consumer loans expected to continue ticking upward.

- Homeowners spent an average of about $4,000 on repairs last year, according to the research.

For homeowners, big projects and purchases may be another casualty of rampant inflation, new research suggests.

Overall, 60% of homeowners in a recent survey are less comfortable making large purchases for their home or household because of rising prices, according to Hippo Insurance’s 2022 Homeowner Preparedness Report. And nearly 43% either strongly (14.4%) or somewhat (28.4%) agree that inflation has caused them to delay planned home improvement or maintenance projects.

The poll used to generate the study was conducted April 29 to May 1 among 1,915 U.S. adults, by Ipsos on behalf of Hippo.

More from Personal Finance:

Cost to finance a new car hits a record $656 per month

How to get started building credit as a young adult

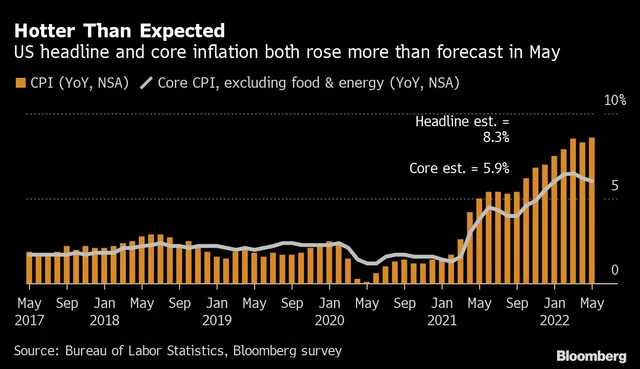

Here’s what the Fed’s interest rate hike means for youWith inflation up 8.6% year over year in May — more than expected and the fastest pace since 1981 — households are facing price increases in everything from groceries and gas to rent and clothes, according to the latest data from the U.S. Bureau of Labor Statistics. Generally speaking, demand continues to outstrip supply, which is hampered in many cases by supply-chain issues.

Residential housing construction costs are up 19% from a year ago, according to the National Association of Home Builders. This can translate into higher costs for home improvement projects, depending on the specifics. The housing market appears to be cooling amid higher interest rates and skyrocketing home prices, however; the median list price of a home in the U.S. is $447,000, up 17.6% from a year ago, according to Realtor.com.