Next up for markets: Fed could set a hawkish tone

- The Fed is likely to reveal some detail about its plan to begin the unwind of its $4.5 trillion balance sheet when it releases minutes from its last meeting at 2 p.m.

- If the Fed seems confident that inflation will move higher, or shows it wants to tighten because of financial conditions, the market may take its message as "hawkish."

- A hawkish Fed, appearing ready to raise interest rates, could trigger a sell-off in stocks and in Treasurys, which would send bond yields higher.

CNBC.com

38

SHARES

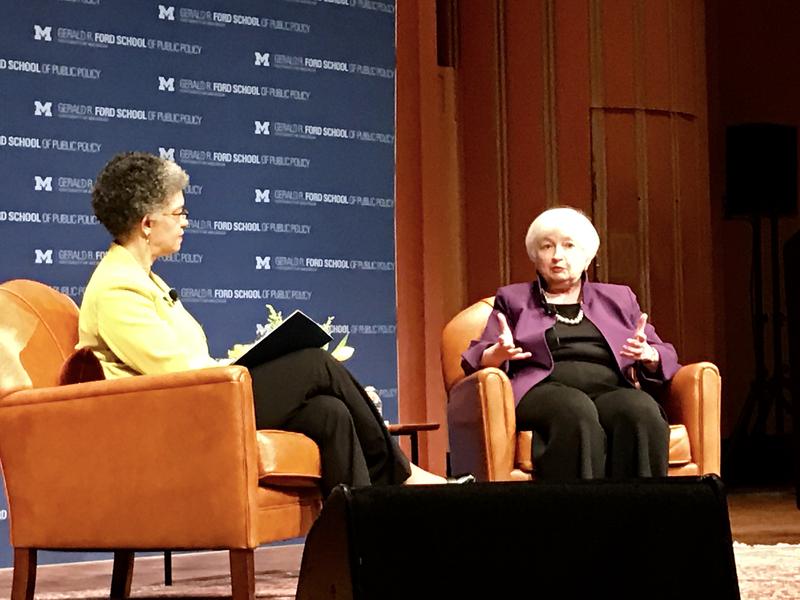

Joshua Roberts | Reuters

Federal Reserve Board Chairwoman Janet Yellen

The Federal Reserve could have an impact on trading when it releases the minutes from its last meeting Wednesday afternoon, particularly if it appears confident that it could raise interest rates again this year.

The Fed is also likely to provide some insight into its plan to unwind its $4.5 trillion balance sheet, which many market pros expect to begin in September. The Fed intends to taper back on its practice of replacing Treasurys and mortgages, as the issues it holds mature. Those securities were first purchased as part of the extraordinary easing it used to fight the financial crisis.

But traders were also focused on the fact that Fed speakers and even the European Central Bank have been sending somewhat hawkish messages recently, and the minutes could lean toward those comments.

"It almost seems like a concerted message from people at the Fed about financial conditions being very easy, perhaps too easy," said Stephen Stanley, chief economist at Amherst Pierpont. "It would be interesting to see if the committee discussed that and what the rhetoric was. …[Janet] Yellen, [Stanley] Fischer, [William] Dudley, each of them talked about financial conditions being easy one way or the other."

Stanley said Dudley, the New York Fed president, has made it clear if the Fed raises rates, and the markets react, it could slow its hiking. But if markets do not react at all, the Fed could increase its activity, he said.

The Fed minutes, to be released at 2 p.m. ET, are the first in a series of events that could reveal more about Fed policy for the second half of the year. On Friday, the June employment report will be released, and markets are watching the wages data to see if there are any early signs of returning inflation. Later Friday morning, the Fed will release its semi-annual monetary policy report at 11 a.m. ET, five days ahead of Fed chair Yellen's economic testimony before Congress. Then, the Federal Open Market Committee meets again on July 25 and 26, where it is not expected to take action on interest rates but could reveal more about its intentions.

The markets have doubted the Fed will hike rates for a third time this year, giving just about 50 percent odds for a September rate rise. Analysts are watching the minutes to see if the Fed signals that the recent dip in inflation is temporary and that it is on track to move ahead on interest rates unless the economy softens.

Bond market pros are also looking to see if the Fed will reveal any clues about when it will start tapering back its purchases of Treasury and mortgage securities.

The minutes are from the June 14 meeting when the FOMC raised rates for a second time this year and revealed details on how it intends to gradually begin paring back its balance sheet.

"Right now, many market participants don't expect a [rate hike] in September," said Kate Warne, investment strategist at Edward Jones. "Investors are thinking they won't move unless they get stronger inflation." She said the Fed could indicate it is willing to discount the downward move in inflation as short-term.

"If the minutes are more hawkish than expected, we would see investors surprised by the minutes. I don't think that's likely to be the case. Stocks would probably react negatively and interest rates would continue to rise," Warne said.

Stocks started out the month of July Monday on an upswing that sent the Dow to new highs, but selling in technology stocks pulled down the Nasdaq. On Wednesday, stocks opened slightly higher, after the July 4 holiday Tuesday. Treasury yields were also higher, and the dollar was firmer, ahead of the release of Fed minutes.

The yield on the 2-year note, the most sensitive to Fed hiking, was at 1.41 percent, after touching 1.426 percent Monday, its highest level since 2009.

"I think the expectations are for the Fed to confirm their tapering intentions," said Ian Lyngen, head of U.S. rates strategy at BMO.

"I think a September taper has become very consensus," said Lyngen. "If you see a uniform view reflected within the minutes, I think it's going to be bearish in the Treasury market because it suggests there will be follow-through with the tapering and hiking. If there's a divergence, it would be bullish."

Treasury yields move opposite prices, so a hawkish view would send rates higher.

"I don't really think they're going to change the overall tone or direction of the Treasury market," said Lyngen, adding he would expect the most action in the 5-year note as a reflection of future Fed policy moves. The 5-year yield was at 1.93 percent Wednesday. The 10-year was at 2.34 percent.

"I certainly don't think we'll get a rate hike in July, but I do think there's a chance we'll get the balance sheet announcement in July," said Lyngen. "You could make a case for September. My thought is they want to keep the balance sheet discussion separate as much as possible."

The Fed has said it would pause in its rate hiking when it begins action on its balance sheet. The balance sheet reduction is expected to put slight upward pressure on interest rates.

The Fed said it would cap its tapering back of purchases of Treasurys and mortgages at $10 billion a month, before increasing the cap at three-month intervals. The Fed is not adding to its balance sheet any longer, but it does replace securities it holds as they mature. It is that process that will be "tapered" back.