Jeff Greene

THE PALM BEACH POST/ZUMA PRESS/ALAMY

Bobby Darvish has been involved in the mortgage industry since 1998 He is a Certified Mortgage Planning Specialist from CMPS Institute, has studied residential mortgage & commercial mortgage underwriting courses, is a Business Finance Consultant graduate as well as a licensed broker.

Jeff Greene

THE PALM BEACH POST/ZUMA PRESS/ALAMY

It's time to pull out Jimmy McMillan's slogan for his 2010 New York mayoral run: “The rent is too damn high.” But today, the slogan applies across the country as renters feel the squeeze.

https://news.yahoo.com/housing-york-city-board-votes-150343830.html?contentType=VIDEO

The median monthly rent in May hit $1,849, a 26.6% increase since 2019 before the pandemic, according to Realtor.com’s Monthly Rental Report.

“Single-family rents continue to increase at record-level rates,” Molly Boesel, principal economist at CoreLogic, said in a statement regarding its Single-Family Rent Index (SFRI) report. “In April, rent growth provided upward pressure on inflation, which rose at rates not seen in nearly 40 years. We expect single-family rent growth to continue to increase at a rapid pace throughout 2022.”

During the pandemic, rent moratoriums and rent assistance programs helped renters who were laid off stay in their apartments. With the expiration of those programs, rent affordability is becoming a crisis with rising inflation.

Where you live will determine the amount of your rent hike. In Miami, rent increases are averaging 40.8% with Orlando seeing increases of 25.8% and Phoenix 17.8%.

“Rent and for-sale listing prices are closely correlated,” according to Realtor.com’s report. Therefore, it’s not surprising that rents are high in Miami and Phoenix, as both cities typically lead in S&P CoreLogic Case-Shiller national home price 20-city index.

New Yorkers are complaining about 40% rent increases, with the average rent on a (non-subsidized) apartment in May was $4,975 a month, a 22% from last year.

For rent-subsidized New Yorkers, the New York City housing board voted to increase rent for rent-stabilized homes 3.25% for one-year leases and 5% for two-year leases.

“There’s no question that renters are facing sky high prices. And with rising inflation reflecting price jumps for both rents and everyday expenses, many renters are feeling the strain on their finances,” Danielle Hale, chief economist at Realtor.com, said in a press release. In a bit of good news for renters, last month’s prediction of rents surpassing $2,000 sometime this summer is going to take longer to materialize.”

Ronda is a personal finance senior reporter for Yahoo Money and attorney with experience in law, insurance, education, and government.

Follow her on Twitter @writesronda Read the latest personal finance trends and news from Yahoo Money. Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn.

U.S. home prices climbed to another record high in April, as inflation continued to run hot across the housing market in the spring.

The latest S&P CoreLogic Case-Shiller index released Tuesday put the annual increase in the cost of a home at 20.4% in April, down slightly from the prior month's upwardly revised jump of 20.6%.

The pace of increases slowed marginally for the first time since November in a potential sign home prices may be beginning to cool, but many cities across the country continued to see prices soar at a quickened pace.

“April 2022 showed initial (although inconsistent) signs of a deceleration in the growth rate of U.S. home prices,” Craig Lazzara, managing director at S&P DJI, said in a statement. “We continue to observe very broad strength in the housing market, as all 20 cities notched double -digit price increases for the 12 months ended in April. April’s price increase ranked in the top quintile of historical experience for every city, and in the top decile for 19 of them.”

Cities that saw the biggest price accelerations were Tampa, Miami and Phoenix, with year-over-year home prices gains of 35.8%, 33.3%, and 31.3%, respectively.

Moreover, S&P CoreLogic Case-Shiller’s 10-city composite registered an annual increase of 19.7%, climbing from 19.5% in March. The 20-city composite saw an annual gain of 21.2% compared to 21.1% during the prior month.

As Dan Rawitch, the great bond analyst states:

Bonds are once again under pressure. The ten-year has risen above the 3.20 level and appears to be headed toward 3.30. The MBS is sitting on a critical support level of 97.50. It needs to hold or we risk 97.20 at a minimum. The news today was mixed. Consumer confidence was once again hammered and I give this the most weight. Perhaps later the market will agree with me. This pullback seems more technical than fundamental and it needs o run its course. Thursday is a massive news day, lets hope it bring us favorable bond news.

https://www.ratewatch.com/ratewatchnow.html

This week we update you on what happened last week with the economy and how it will impact the markets this week. We also share some of the stocks we are eyeing between now and Friday the1st of July:

An excellent comprehensive but yet simplified video featuring the 2022 state of the nation housing market by Harvard Joint Center of Housing:

After a record-shattering year in 2021, the housing market is at an inflection point. Higher interest rates have taken some heat out of the homebuying market, and the large number of apartments under construction should bring some relief on the rental side. For lower-income households and households of color, though, the pressure of high housing costs is unlikely to relent. According to our new The State of the Nation’s Housing 2022 report, the surge in the prices of gas, food, and other necessities has made matters worse, especially now that most pandemic emergency government supports have ended.

With interest rates rising, on top of double-digit home price increases, the income and savings needed to qualify for a home loan have skyrocketed. Potential homebuyers saw monthly mortgage payments on the median-priced US home rise by more than $600 over the past year. At today’s prices, the typical downpayment that a first-time buyer would need for a median-priced home is $27,400, which would rule out 92 percent of renters, whose median savings are just $1,500.

With interest rates rising, on top of double-digit home price increases, the income and savings needed to qualify for a home loan have skyrocketed. Potential homebuyers saw monthly mortgage payments on the median-priced US home rise by more than $600 over the past year. At today’s prices, the typical downpayment that a first-time buyer would need for a median-priced home is $27,400, which would rule out 92 percent of renters, whose median savings are just $1,500.Bonds are flat this morning. The only news released was the existing home sales number, which was terrible. No surprise there. It is impossible to have housing affordability at an all-time low, with record consumer debt and the savings rate falling like a rock, without seeing a slowing in home sales and prices. We now have the retail inventory to sales ratio at nearly all-time highs. You may recall when the inflation storm started, I said that people were flush with cash and that all the buying and growth in the economy was revenge buying. My analogy was that people got starving (metaphorically speaking) while on lockdown.

Bloomberg) -- US house prices are likely to fall as mortgage rates exceeding 6% crimp affordability for the average buyer, according to Capital Economics.

https://finance.yahoo.com/news/us-house-prices-likely-drop-162844538.html

Properties could contract an annual 5% by the middle of next year, Matthew Pointon, senior property economist, said in a research note Monday. He’d previously projected no change in values by that time.

An average household looking to buy a home for the median price will now have to put more than a quarter of their annual income toward mortgage payments, according to the report. That surpasses the average 24% seen in the mid-2000s.

“That deterioration in affordability will shut many potential buyers out of the market,” Pointon wrote. “That will reduce the competition for homes, and sellers will eventually see the need to accept a lower price for their property.”

The Federal Reserve’s actions to get inflation under control has squeezed U.S. housing market activity, though prices have so far stood firm. Capital Economics expects property values to rebound to a 3% annual gain by the end of 2024.

Most Read from Bloomberg Businessweek

For homeowners, big projects and purchases may be another casualty of rampant inflation, new research suggests.

Overall, 60% of homeowners in a recent survey are less comfortable making large purchases for their home or household because of rising prices, according to Hippo Insurance’s 2022 Homeowner Preparedness Report. And nearly 43% either strongly (14.4%) or somewhat (28.4%) agree that inflation has caused them to delay planned home improvement or maintenance projects.

The poll used to generate the study was conducted April 29 to May 1 among 1,915 U.S. adults, by Ipsos on behalf of Hippo.

More from Personal Finance:

Cost to finance a new car hits a record $656 per month

How to get started building credit as a young adult

Here’s what the Fed’s interest rate hike means for you

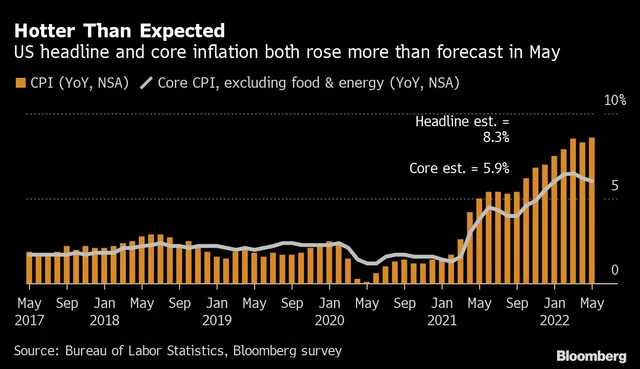

With inflation up 8.6% year over year in May — more than expected and the fastest pace since 1981 — households are facing price increases in everything from groceries and gas to rent and clothes, according to the latest data from the U.S. Bureau of Labor Statistics. Generally speaking, demand continues to outstrip supply, which is hampered in many cases by supply-chain issues.

Residential housing construction costs are up 19% from a year ago, according to the National Association of Home Builders. This can translate into higher costs for home improvement projects, depending on the specifics. The housing market appears to be cooling amid higher interest rates and skyrocketing home prices, however; the median list price of a home in the U.S. is $447,000, up 17.6% from a year ago, according to Realtor.com.

In a historic move the Federal Reserves increased rates by 0.75% :

https://apnews.com/article/stock-market-updates-today-june-15-927c4420702d69f1fde6d07b3678e61a

(Bloomberg) -- US inflation accelerated to a fresh 40-year high in May, a sign that price pressures are becoming entrenched in the economy. That will likely push the Federal Reserve to extend an aggressive series of interest-rate hikes and adds to political problems for the White House and Democrats.

The consumer price index increased 8.6% from a year earlier in a broad-based advance, Labor Department data showed Friday. The widely followed inflation gauge rose 1% from a month earlier, topping all estimates. Shelter, food and gas were the largest contributors.

https://www.bloomberg.com/news/articles/2022-06-10/us-inflation-unexpectedly-accelerates-to-40-year-high-of-8-6

You can't go a day without hearing that interest rates have risen this year and these higher rates are making it harder on the average consumer.

Yet, there are some positive sides of higher interest rates. #economy

https://t.co/NDZEp6jkHv

Bobby Darvish